Fraud Detection Monitoring Compliance Oversight Bureau 3511357949 3510565396 3899308682 3313622605 3517612956 3509834424

The Fraud Detection Monitoring Compliance Oversight Bureau plays a critical role in safeguarding financial integrity. It utilizes specific identification numbers, such as 3511357949 and 3510565396, to track transactions effectively. These numbers are instrumental in identifying irregularities that may suggest fraudulent activities. By implementing stringent oversight measures and promoting transparency, the Bureau aims to enhance accountability. However, the true extent of its impact on reducing fraud remains to be explored further.

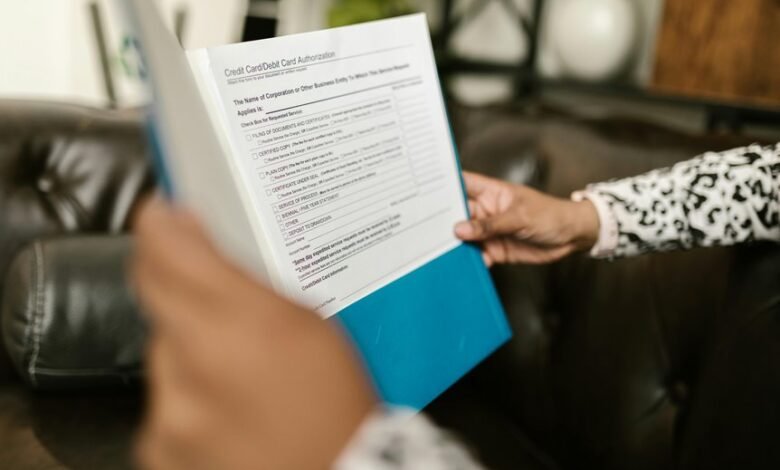

The Role of the Fraud Detection Monitoring Compliance Oversight Bureau

The Fraud Detection Monitoring Compliance Oversight Bureau serves as a critical entity in ensuring adherence to regulatory standards and the integrity of financial systems.

It employs robust fraud prevention strategies and compliance enforcement mechanisms to mitigate risks associated with fraudulent activities.

Key Identification Numbers and Their Significance

While various identification methods exist, key identification numbers play a pivotal role in fraud detection and compliance monitoring within financial systems.

These numbers facilitate the tracking of transactions, ensuring compliance significance by identifying anomalies that may indicate fraudulent activities.

Their systematic application enhances accountability and transparency, empowering institutions to uphold integrity while safeguarding against potential risks that threaten financial stability.

Enhancing Transparency in Financial Systems

Enhancing transparency in financial systems requires the implementation of robust frameworks that promote clear communication and information accessibility.

By prioritizing financial accountability, stakeholders can foster trust and ensure system integrity.

These frameworks enable organizations to disclose relevant data, facilitating informed decision-making and reducing opportunities for fraud.

In turn, this transparency empowers individuals and entities to engage with financial systems confidently and responsibly.

Mitigating Risks Through Effective Oversight

Effective oversight plays a critical role in mitigating risks associated with fraud and financial misconduct.

Implementing robust risk assessment processes and oversight strategies enables organizations to identify vulnerabilities proactively.

Conclusion

In conclusion, the Fraud Detection Monitoring Compliance Oversight Bureau stands as a modern-day sentinel, guarding the integrity of financial systems with its critical identification numbers. Much like the vigilant watchmen of ancient cities, the Bureau’s commitment to transparency and oversight mitigates the specter of fraud, fostering a climate of trust among stakeholders. By employing rigorous monitoring strategies, it not only identifies anomalies but also fortifies the foundations of financial stability, echoing the age-old adage that prevention is better than cure.